The smart Trick of Paul B Insurance That Nobody is Talking About

Wiki Article

The 8-Second Trick For Paul B Insurance

The thought is that the money paid in insurance claims gradually will be less than the complete premiums collected. You might really feel like you're throwing cash gone if you never submit a case, however having item of mind that you're covered on the occasion that you do experience a considerable loss, can be worth its weight in gold.

Envision you pay $500 a year to insure your $200,000 house. This implies you've paid $5,000 for residence insurance policy.

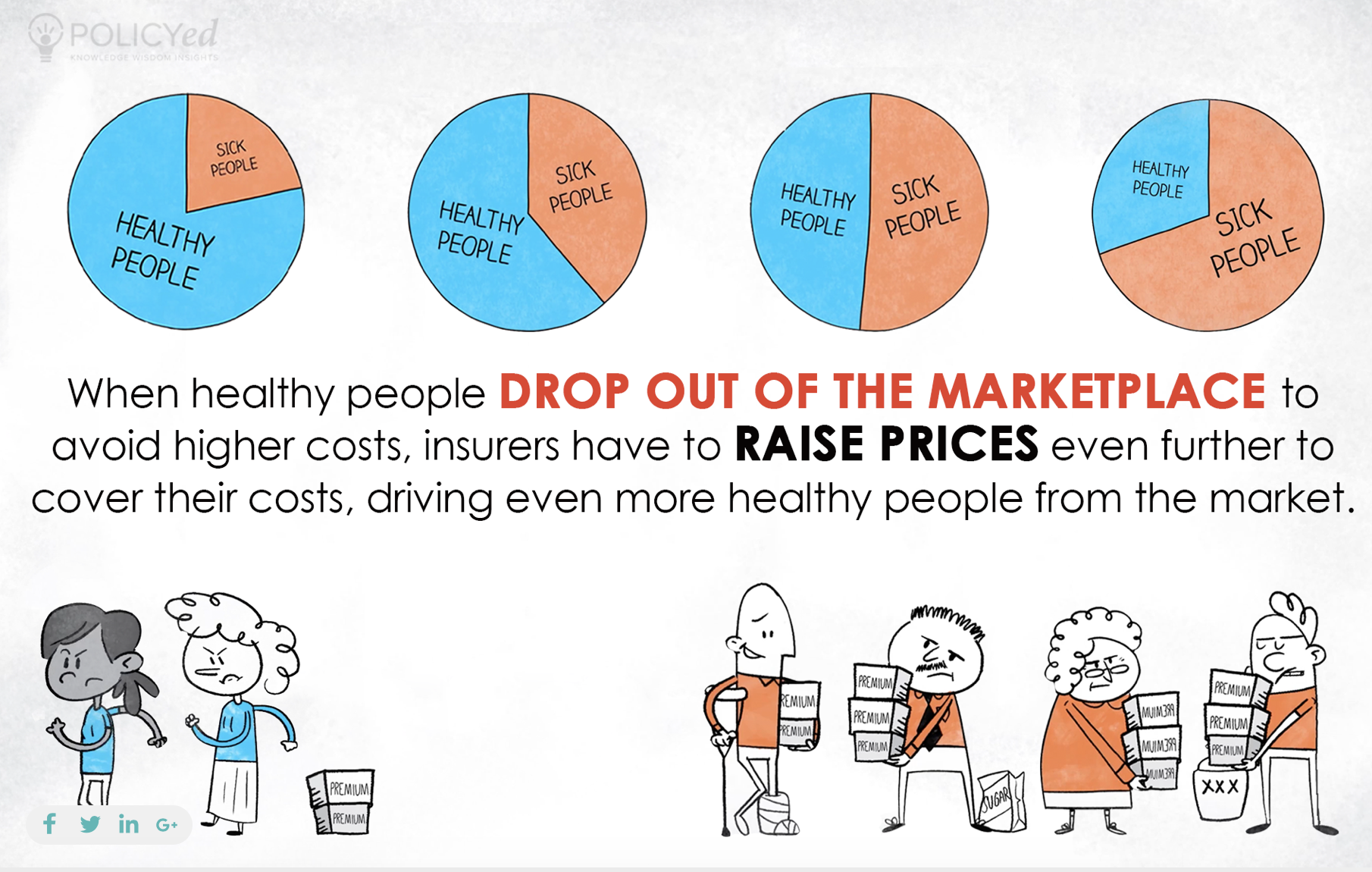

Since insurance coverage is based on spreading out the risk amongst many individuals, it is the pooled money of all individuals spending for it that enables the firm to build properties and cover insurance claims when they happen. Insurance coverage is a business. It would be great for the firms to just leave rates at the exact same degree all the time, the reality is that they have to make sufficient cash to cover all the possible claims their insurance policy holders might make.

Some Ideas on Paul B Insurance You Need To Know

Underwriting modifications and rate boosts or declines are based on results the insurance policy business had in previous years. They sell insurance policy from only one company.

The frontline individuals you take care of when you purchase your insurance policy are the representatives and brokers that represent the insurance policy business. They will clarify the kind of here items they have. The captive representative is a representative of just one insurance provider. They an aware of that company's items or offerings, but can not talk towards various other companies' plans, pricing, or item offerings.

They will certainly have access to greater than one business and have to find out about the series of products used by all the companies they stand for. There are a few vital concerns you can ask on your own that may aid you choose what sort of protection you require. Just how much risk or loss of cash can you assume by yourself? Do you have the money to cover your expenses or debts if you have a mishap? What about if your house or car is wrecked? Do you have the cost savings to cover you if you can not work because of a crash or disease? Can you manage higher deductibles in order to lower your costs? Do you have unique demands in your life that require additional insurance coverage? What issues you most? Plans can be tailored to your requirements and also identify what you are most concerned concerning protecting.

visitA Biased View of Paul B Insurance

resourceThe insurance policy you require differs based upon where you go to in your life, what type of possessions you have, as well as what your lengthy term goals as well as responsibilities are. That's why it is important to make the effort to discuss what you want out of your plan with your representative.

If you secure a lending to buy an automobile, and afterwards something happens to the car, gap insurance policy will certainly settle any type of section of your financing that typical automobile insurance coverage doesn't cover. Some lenders need their debtors to carry gap insurance policy.

The primary function of life insurance is to provide cash for your recipients when you die. Depending on the type of policy you have, life insurance policy can cover: Natural fatalities.

The Ultimate Guide To Paul B Insurance

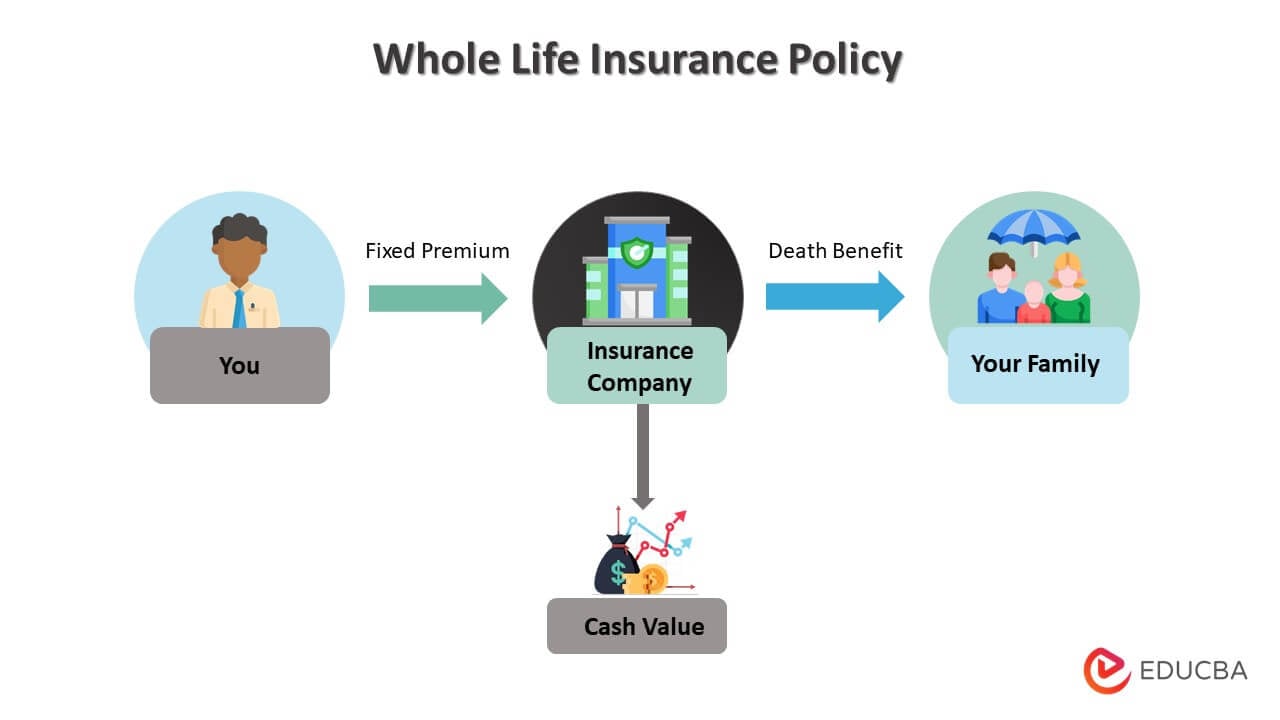

Life insurance policy covers the life of the insured individual. The insurance policy holder, that can be a different individual or entity from the insured, pays costs to an insurance provider. In return, the insurance provider pays a sum of money to the recipients listed on the policy. Term life insurance policy covers you for a time period picked at purchase, such as 10, 20 or thirty years.

If you don't die throughout that time, no person earns money. Term life is prominent due to the fact that it provides huge payments at a lower price than irreversible life. It also offers insurance coverage for an established number of years. There are some variations of normal term life insurance policy policies. Convertible policies enable you to transform them to irreversible life plans at a higher premium, permitting longer as well as possibly a lot more adaptable coverage.

Irreversible life insurance coverage policies build cash worth as they age. The money value of whole life insurance plans expands at a set rate, while the cash value within global policies can change.

The Single Strategy To Use For Paul B Insurance

If you contrast average life insurance policy rates, you can see the distinction. $500,000 of entire life coverage for a healthy and balanced 30-year-old woman expenses around $4,015 yearly, on standard. That same degree of protection with a 20-year term life plan would set you back approximately about $188 every year, according to Quotacy, a brokerage company.

Variable life is an additional permanent life insurance coverage alternative. It's an alternate to entire life with a fixed payout.

Right here are some life insurance fundamentals to aid you much better understand exactly how insurance coverage functions. Premiums are the repayments you make to the insurer. For term life plans, these cover the price of your insurance as well as management costs. With a long-term policy, you'll likewise have the ability to pay money right into a cash-value account.

Report this wiki page